KE Application for Removal of Tax Obligation(s) 2019-2026 free printable template

Show details

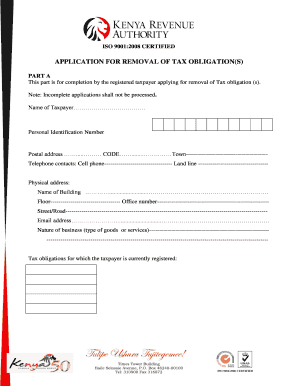

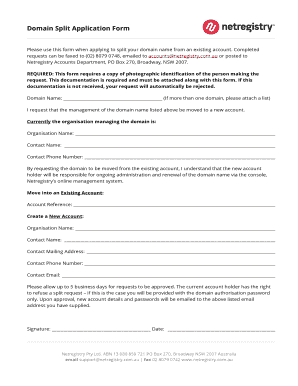

ISO 9001:2015 CERTIFIEDAPPLICATION FOR REMOVAL OF TAX OBLIGATION(S) PART A part is for completion by the registered taxpayer applying for removal of tax obligation(s). Note: Incomplete applications

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign file return form

Edit your how to request for waiver kra form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kra waiver form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit how to apply for kra penalty waiver online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit how to apply for kra waiver form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KE Application for Removal of Tax Obligation(s) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kra waiver penalty form

How to fill out KE Application for Removal of Tax Obligation(s)

01

Gather necessary documents, such as tax obligation statements and your identification.

02

Complete the KE Application form, ensuring all sections are filled out accurately.

03

Provide details of the specific tax obligations you wish to have removed.

04

Attach any supporting documents that justify your request for removal.

05

Review the application for completeness and accuracy.

06

Submit the application to the appropriate tax authority, either online or by mail.

Who needs KE Application for Removal of Tax Obligation(s)?

01

Individuals or businesses that have outstanding tax obligations and believe they qualify for removal.

02

Those who are facing financial hardship and need assistance in addressing their tax liabilities.

03

Taxpayers who have resolved previous issues or errors related to their tax obligations.

Fill

how to apply for a waiver on itax

: Try Risk Free

People Also Ask about how to apply for waiver kra

How do I check my penalties in KRA portal?

For you to be able to check KRA Penalties on iTax Web Portal Account, you will need to click on the Debt and Enforcement menu followed by Request for Waiver of Penalties and Interests. This is the quickest way to check all KRA Penalties in your iTax Account.

What does KRA deal with?

KRA was established as an Act of Parliament, Chapter 469 of the Laws of Kenya. It is charged with the responsibility of collecting revenue. After independence, other taxes were introduced, such Income Tax, Corporation Tax, Trade Taxes, Excise Taxes and Customs Offices.

How do I pay my KRA penalty on taxes?

After filing the return online via iTax, generate a payment slip and present it at any of the appointed KRA banks to pay the due tax. You can also pay via Mpesa. Use the KRA Pay bill number 572572. The Account Number is the Payment Registration number quoted at the top right corner of the generated payment slip.

How do you write a penalty letter?

You are requested to submit this penalty with the HR department and we would appreciate that you report to work on time and in case of emergency, keep your team informed. Any kind of delayed reporting will not be appreciated in future and will attract greater penalty.

How do I write a letter of waiver to KRA?

Writing KRA Waiver Letter is quite simple. There is no specific format for writing the Waiver letter. You just need to write explaining the reasons why the penalties occurred and justify why you requesting for a waiver. The contents of a KRA Waiver Letter are basically not that many.

Can penalties be waived?

If you believe that a penalty should be waived because the failure to pay the tax on time was due to reasonable cause and was not intentional or due to neglect, you have the right to request a penalty waiver.

How do I claim my KRA tax waiver?

All the principal taxes must be fully paid before an application can be lodged for consideration for waiver. The taxpayer has to be compliant in other taxes with regard to filing and payment of taxes. The applicant's past compliance record is taken into account when processing the waiver application.

How do I get my tax penalty waived?

Write a letter to the IRS requesting a penalty waiver. State the reason you weren't able to pay, and provide copies—never the originals—of the documents you're offering as evidence. You should mail the letter to the same IRS address that notifies you about your penalty charges.

How do you write an application for a waiver?

Respected Sir, I hope all is well with you. I am writing this email in the hope of getting my application fee waived for this (name of) college. My name is _ and I have completed my schooling or Bachelor's from and since then wanted to enrol myself for my further education in your institute.

What happens if you don't pay KRA?

Failure to pay tax on due date. Penalty - 20% of tax involved is charged. Offence - Failure to file annual returns by the due date. Penalty - Additional tax equal to 5% of the normal tax, or Ksh.

How do I write a letter requesting KRA for a waiver?

Writing KRA Waiver Letter is quite simple. There is no specific format for writing the Waiver letter. You just need to write explaining the reasons why the penalties occurred and justify why you requesting for a waiver. The contents of a KRA Waiver Letter are basically not that many.

How do I clear my KRA penalty?

The Penalties are debited in the taxpayer's KRA account and they can not get a Tax Compliance certificate until they are paid. A taxpayer is required to write a letter to the commissioner requesting a waiver on the penalties for consideration when they need to apply for a tax compliance certificate.

How do I apply for a KRA waiver letter?

Writing KRA Waiver Letter is quite simple. There is no specific format for writing the Waiver letter. You just need to write explaining the reasons why the penalties occurred and justify why you requesting for a waiver. The contents of a KRA Waiver Letter are basically not that many.

How do I remove a penalty from KRA?

What is Kenya revenue authority (kra) waiver application? That all applications for waiver of penalty and interest are properly justified and supported with proper evidence. That the principal tax has been paid. That the taxpayer has been tax compliant on all other taxes.

How do I ask for a waiver of penalty?

Taxpayers may request a waiver of the penalty amount as long as the request is in writing and the principal tax and interest amounts due are paid. Written requests for a waiver of the penalty will be considered on a case-by-case basis. If the waiver is denied, the penalties will be billed at a future date.

What is a penalty abatement request letter?

The IRS invokes something called first-time penalty abatement relief (FTA). This can be used for failure-to-file or failure-to-pay penalties, as long as you're in good standing otherwise and have a clean penalty history. These requests can be done by phone and are separate from reasonable cause relief.

How do I file a KRA tax waiver?

All the principal taxes must be fully paid before an application can be lodged for consideration for waiver. The taxpayer has to be compliant in other taxes with regard to filing and payment of taxes. The applicant's past compliance record is taken into account when processing the waiver application.

What is a KRA waiver?

A waiver application is a request made by a taxpayer for consideration. penalties and interest to be remitted where they fail to pay their taxes. or file returns by stipulated due dates to Commissioner Domestic Taxes. This provision covers only penalty and interest.

How do I get a waiver for an IRS penalty?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify kra apply tax without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including how to apply for kra waiver online, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for signing my kra waiver application form in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your tax return and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete how to apply kra waiver on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your application tax return, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is KE Application for Removal of Tax Obligation(s)?

KE Application for Removal of Tax Obligation(s) is a formal request made to the tax authority to eliminate or reduce tax liabilities under specific circumstances, usually for individuals or entities that meet certain criteria.

Who is required to file KE Application for Removal of Tax Obligation(s)?

Typically, individuals or entities that have outstanding tax obligations and believe they qualify for removal or reduction due to financial hardship, insolvency, or other lawful reasons are required to file this application.

How to fill out KE Application for Removal of Tax Obligation(s)?

To fill out the KE Application for Removal of Tax Obligation(s), an applicant must complete the designated form accurately, providing all required personal and financial information as well as supporting documentation that justifies their request.

What is the purpose of KE Application for Removal of Tax Obligation(s)?

The purpose of the KE Application for Removal of Tax Obligation(s) is to allow taxpayers to formally request the tax authority to consider their situation and potentially relieve them from some or all of their tax liabilities.

What information must be reported on KE Application for Removal of Tax Obligation(s)?

The information that must be reported includes personal identification details, the nature of the tax obligations, financial statements, reasons for the request, and any supporting documents that validate the claims made in the application.

Fill out your KE Application for Removal of Tax Obligations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Apply Waiver In Kra is not the form you're looking for?Search for another form here.

Keywords relevant to how to apply for tax waiver

Related to how to apply kra waiver online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.