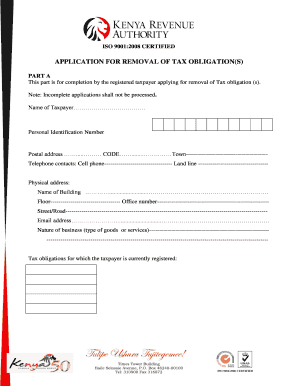

KE Application for Removal of Tax Obligation(s) 2019-2024 free printable template

Get, Create, Make and Sign

How to edit kra waiver application form online

KE Application for Removal of Tax Obligation(s) Form Versions

How to fill out kra waiver application form

How to fill out kra waiver application form

Who needs kra waiver application form?

Video instructions and help with filling out and completing kra waiver application form

Instructions and Help about tax file return form

Hi everybody Dave Sullivan with the credit guy TV My number one video I have done so far is Removing an IRS tax lien From your credit report I actually have a client that went out and followed my instructions and actually got the IRS tax lien removed Under a new program that I announced About a year ago So what I want to do is take you through The documents they used step by step to get the IRS tax Lien removed So that you can follow these instructions easily and get so lets take a look at that now. I want to run you through this form real quick the application for removal of a filed IRS tax lien it is form 12277 and a link to this form will be below the video under Facebook.com/thecreditguy under the notes section you will find a link to the form directly, but you put in the taxpayer name social security number you can leave this line blank address city state zip phone number you should already have this form the 688Y form you should have already revived this form when the tax lien was established and the 688Y form looks like this you are going to include this form with your application If you can not find it then you have to request a new copy, but you need to have the 688Y form in order to apply you are going to fill this all out and then for number 10 you are going to check open released or unknown This is the line you want to check on question 12 you want to write something along the lines of this that you would like it removed under the new fresh start policy of the IRS That you meet all the qualifications and eligibility any you want to print this out and mail it to the three repositories. Along with everything else and mail it certified mail is how you want to send that out then sign it put it together with the 688Y form and the letter, and then you are going to mail it to the one of these addresses where ever your local IRS office is where ever that Tax Lien was recorded I will have a link to all this on my website www.thecreditguy.tv it depends on where the tax line was recorded where you send that form in it is that easy You should plan on it taking one to two months to, but it is a lot better than leaving it on your credit report and harming your credit score so let me wrap this up It is that easy to fill out the forms send them in to the IRS and then get a copy then send it to the repositories and then get an IRS Tax lien removed right off your credit report like it was never there it is very new in the credit industry prior to actually paying it of in full I hope you take advantage If you have any questions please share this video or the other video and subscribe for free on your Left Thank you, Dave Sullivan so you with a little of me we are going to change the credit industry.

Fill waiver application form kra : Try Risk Free

People Also Ask about kra waiver application form

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your kra waiver application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.